State of the PM industry in North America – 2015

1st Jun, 2015

The PM industry continued its growth track last year, and most indicators signal a repeat performance in 2015. Metal powder producers, equipment suppliers, and PM parts makers look ahead to favorable business conditions. The metal injection molding (MIM) industry, hot isostatic press (HIP) business, and specialty PM products markets are gaining as well.

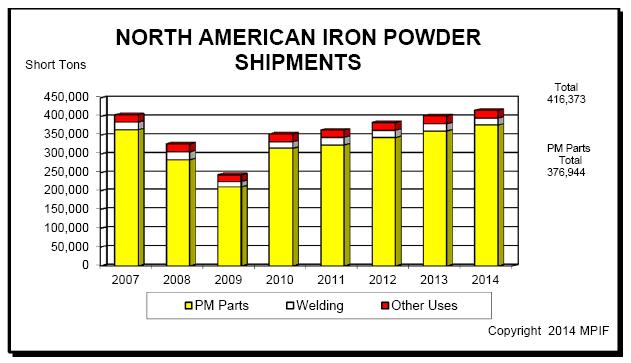

Metal powder shipments modestly increase

2014 North American iron powder shipments rose a modest 3.6% to 416,373 short tons. The PM sector of this total shipments figure increased by almost 4.4% to 376,944 short tons.

While iron powder shipments topped 400,000 short tons again, we must keep in perspective the year 2004 when shipments hit a record 473,804 shorts tons. Estimated stainless steel, copper, aluminum, nickel, molybdenum, tungsten, and tungsten carbide powder shipments grew in 2014 as follows: stainless steel 7,850 short tons; copper 17,500 short tons; aluminum 40,000 short tons; nickel 6,000 short tons; molybdenum 1,940 short tons; tungsten 3,600 short tons; tungsten carbide 5,900 short tons. Total estimated metal powder shipments in 2014 increased by 3.4% to 499,213 short tons - see below.

North American Metal Powder Shipments

2013 2014

Iron & Steel 401,738 416,373

Stainless Steel 7,600 (E) 7,900 (E)

Copper & Copper Base/Tin* 16,850(E) 17,500 (E)

Aluminum 37,000 (R) 40,000 (E)

Molybdenum 2,050 (E) 1,940 (E)

Tungsten 4,200(E) 3,600 (E)

Tungsten Carbide 7,700(E) 5,900 (E)

Nickel 5,775(E) 6,000 (E)

Short tons 482,913 499,213

(E) Estimate

(R) Revised estimate

*PM parts only

PM equipment market overall

PM process equipment builders and tooling makers enjoyed a good year in 2014. PM parts fabricators are ordering new equipment for both capacity increases and added capability, including more robotics and automation for both compacting presses and sintering furnaces. There continues to be a strong trend for larger compacting presses, over 500 tons, and presses with more motions. Press shipments seem to be stabilizing at about 20 units annually. In 2013 press shipments rose to 26 presses, with a backlog of 9 presses. In 2014 shipments declined to 19 presses, with a backlog of 11 presses at the end of the year.

Tooling orders remain positive. One major tooling company sees a growing market for helical gears and a demand for finer and tighter dimensions, especially on punch faces at +/- 10 microns after milling and polishing.

PM parts makers large and small are upgrading equipment. For example, one major firm is phasing out older equipment in favor of new CNC equipment and is considering acoustic blending equipment to achieve more homogeneous powder mixes. Another smaller, family owned business will spend $3.5 million on new equipment. These are positive signs reflecting the industry’s health and boding well for future growth.

Current conditions and business outlook

Emerging from another good year, PM parts companies entered 2015 confident about positive growth indicators on the horizon, even spilling over into 2017. A recent survey by the Powder Metallurgy Parts Association reports that two-thirds of the respondents expect business to increase this year.

Most PM fabricators are doing well, but there are still difficulties finding qualified employees, especially die setters. The industry must do more to attract skilled labor and engineering graduates into manufacturing. MPIF recently participated in career fairs at several universities to increase engineering students’ awareness of PM. MPIF staff engaged nearly 100 students while providing opportunities for possible employment.

North American iron, copper, and stainless steel powder shipments should be up again in the three-to-four-percent range. Metal powder companies are actively pursuing developmental projects to meet market needs and improve the performance of raw materials through a reduction of lubricants in binder-treated premixes and the use of a new lubricant for stainless steel PM materials. A new generation of high-performance PM aluminum materials is in the wings as well.

A number of key PM parts makers forecast double-digit growth this year in both automotive and industrial markets. For example, new PM clutch designs are taking hold in snowmobiles, snow throwers, and all-terrain vehicles. PM’s high reliability in high-performance clutches is unquestioned, a welcome sign and an example of the acceptance for PM components that are used under harsh operating conditions.

Automotive trends

While a positive growth outlook remains in 2015 for PM in a potential 17.3 million car-year market, certain headwinds might diminish the pace of this growth.

As we reflect on 2004, when iron powder shipments hit a record 473,804 short tons, we note that North American light-vehicle production was 16.2 million units. In 2014, auto builds advanced to 16.8 million units but iron powder shipments reached only 416,373 short tons. A disconnect appears.

Several explanations suggest themselves. There is a new paradigm for light-weighting in the automotive industry. Consider the example of the new 2015 Ford F-150 truck, which comes in at a weight of some 700 pounds less than the comparable 2014 model; light-weight components such as its aluminum body panels and high-strength steel ladder-frames come straight from technologies used in the aerospace industry. The trend spawned by manufacturers’ quest for higher CAFE numbers is toward smaller powertrains, from eight-, to six-, and to four-cylinder engines, and thus toward fewer and lighter-weight parts, and away from heavy PM bearing caps and powder-forged connecting rods. PM, however, is not alone in feeling this impact: competitive technologies such as castings, wrought forgings, and machined parts must also pony up to meet rising technological requirements.

MPIF recognizes this light-weighting trend as an opportunity. As such, MPIF has joined the Lightweight Innovations for Tomorrow (LIFT), an industry-led, government-funded consortium, to help facilitate technology transfer into supply-chain companies. LIFT is one of the institutes launched by the National Network for Manufacturing Innovation. MPIF's move to gain a voice in this $140+ million dollar program is important for our industry.

Another possible explanation for the disconnect between the increased auto builds and the failure of powder shipments to rise to previous levels is that many new engines and transmissions are being designed in Europe and Asia with less PM content. The number of possible PM applications has decreased. It is said European auto engineers lean towards higher performance over cost and toward closer tolerances. For example, in North America a Class 8 gear is normally acceptable, while European engineers require Class 9 and 10 gears. Meanwhile, a leading German automatic transmission supplier has designed an eight-nine speed transmission for a Detroit 3 auto maker that contains only two PM oil-pump parts.

This trend has had the effect of forcing U.S. parts makers to meet tighter or “Europeanized” tolerance requirements of less than 10 microns across the board. Go-to trends for meeting these demands include surface finish grinding, localized hardening, grinding after heat treating, and grinding or machining for flatness.

Focusing on distinct PM product sectors with more value-added operations is another trend involving big-name PM auto parts makers. For one specialized automotive parts supplier, adding value through extra machining and other specialized post-processing is enabling the company to book business into 2020; the company is already in discussions about designs for the 2021 model year.

PM content in light trucks amounts to between 55 and 60 pounds, with the average PM content in light vehicles estimated at 45 pounds. This is in marked contrast with the average European vehicle, which in 2014 contained an estimated 21 pounds of PM parts.

The metal injection molding (MIM) industry has begun selling into the automotive market. Automotive engineers are designing more MIM parts, which points to significant potential growth as MIM becomes more accepted. MIM parts are being designed for engines, electrical systems, and chassis hardware.

Trends in metal injection molding, hot isostatic pressing and additive manufacturing

Despite some bumps in the MIM business road, namely, the saturated firearms market, 2014 was good to the North American MIM industry. The next three-to-five years look positive as well. According to a 2014 survey by the Metal Injection Molding Association (MIMA), the MIM industry is still ascending its growth-cycle curve at a growth rate well above that of the GDP. Some have even posited that the industry is still in the steepest segment of its growth curve. The MIMA survey reported the following primary end-markets in North America by weight of parts shipped: firearms, 28%; general industrial, 24%; medical/dental, 19%; automotive, 15%; electronics, 9%; and miscellaneous, 5%.

While the firearms market currently remains somewhat sluggish, it will most likely stabilize into a more normal growth pattern. However, overall the MIM industry is set to enjoy a 10% growth rate in 2015, certainly an enviable position.

The HIP market registered gains last year that should continue into 2015. The use of PM HIPed products for the oil-and-gas market will increase, despite declines in oil drilling and fracking. This is mainly due to long lead times for necessary replacement parts. HIPed PM aerospace parts are another growing market.

HIP densification of MIM parts remains a robust growth business, and there is new interest in HIP from the additive manufacturing (AM) sector. Additive manufacturing offers an exciting niche business for PM and metal powder producers. Without a doubt AM presents some very interesting opportunities as a new PM technology. There are currently three well-known commercial PM applications: titanium medical implant parts, cobalt-chrome dental copings, and cobalt-chrome aircraft-engine nozzles made by GE at the rate of 40,000 annually. RollsRoyce is also testing a prototype front bearing housing made from a titanium–aluminum alloy for its Trent XWB-97 engines.

A number of powder makers are working on qualifying gas- and water-atomized powders for AM applications made by laser-based, electron-beam, and ink-jet processes.

Tungsten and refractory metals

The overall tungsten business faced tough times in the second half of 2014 due to weakening oil prices and mining activity. For example, total tungsten powder shipments declined by 14.2% in 2014 to an estimated 3,600 short tons. Tungsten carbide shipments dropped 23.3% to an estimated 5,999 short tons. This year will remain rough as well. Oil-and-gas drilling, important markets for tungsten, could drop by as much as 40 to 60%. The outlook for mining, another well-established market for tungsten products, will remain soft. The only bright spots are automotive and aerospace markets, which unfortunately are not large consumers of tungsten.

MPIF & industry technology support

The MPIF Technical Board is reviewing the importance of reducing dimensional variability in PM parts and taking a look at steps to improve dimensional tolerances out of the compacting press. Board members are gathering information about how process factors such as raw materials, compacting, sintering, and secondary operations influence dimensional control. The ultimate goal is to improve the dimensional tolerances of PM parts by 50%. The board is also studying the development of lean alloys.

The Center for Powder Metallurgy Technology (CPMT), with its 52 industry members, leads the investigation of strain-controlled fatigue for numerous PM materials: resonant acoustical processing to enhance powder mixing; sinter-hardening process improvements for flatness and throughput; die-wall lubrication for warm compaction tooling; shot peening of gears for improved performance; and ways to improve tooling to withstand compacting pressures >60 tsi. CPMT is also providing $32,000 in university scholarships through various family and corporate grants and sponsored four students to attend POWDERMET2015 through another family grant.

Individual PM companies continue funding developmental programs aimed at improved materials and processes to support PM’s growth and future viability. Equipment makers, for instance, are designing more robust multi-platen systems in both servo-controlled hydraulic and electrical compacting presses. Higher-strength PM aluminum alloys are being developed that provide yield strengths of 45,500 psi, as are high-density stainless steels >7.4 g/cm3 by single pressing.

Novel R&D programs are being aimed at multiple-scale particulate composites and combining metallic and ceramic properties, for instance, joining the abrasion resistance and rigidity of ceramics with the toughness and electrical conductivity of metals.

In conclusion, resilience and creativity are the hallmarks of today’s PM industry. Just as it has survived and thrived in the face of previous economic trials, these qualities will help insure that the industry will continue to grow in the face of challenges yet to come.

This story is reprinted from material from MPIF, with editorial changes made by Materials Today. The views expressed in this article do not necessarily represent those of Elsevier.